Our software powers AI-assisted due diligence, enabling the review more opportunities, extract insights faster, and maintain a consistent, transparent evaluation process from first submission to final decision.

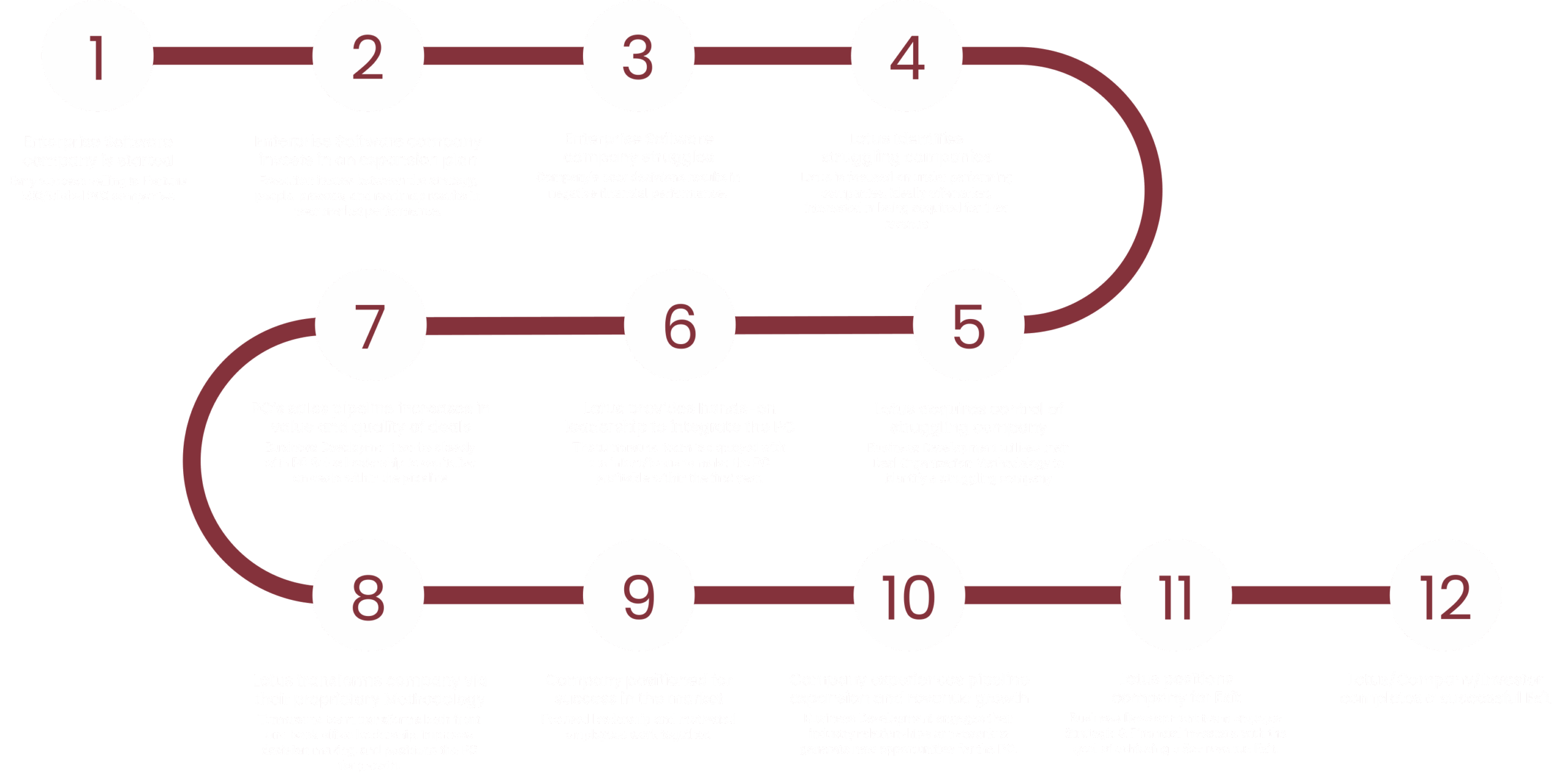

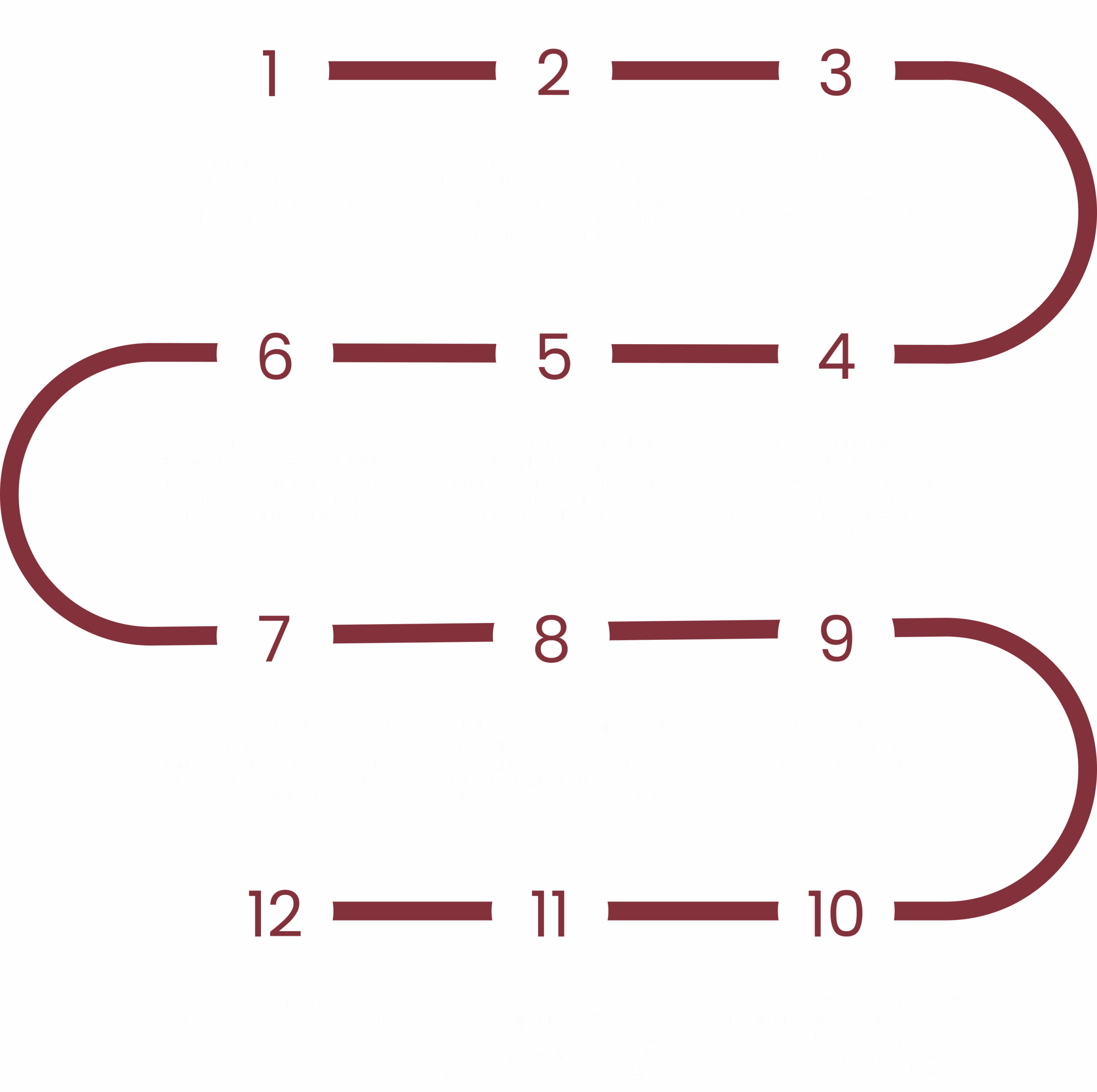

Founders submit their investment materials through the platform, initiating automated data extraction and preliminary validation.

Our AI performs a rapid assessment of the opportunity, checking sector fit, mandate alignment, and basic financial health.

The system processes all uploaded documents to extract key financial, operational, and risk metrics, generating a detailed scorecard.

Qualified opportunities proceed to a meeting with analysts and partners to clarify open points and validate strategic alignment.

The investment team reviews AI-driven insights and human evaluations to discuss potential investment decisions.

A final approval or decline is issued, with structured feedback automatically generated for founders based on scorecard results.

Why Work With Us

/0.1

Operational Support

/0.2

Strategic Growth

/0.3

Flexible Capital

/0.4

Network Access

Lotus Domaine focuses on underperforming, lower-middle market Enterprise Software companies, that meet most of the below criteria

Revenue

Between $1-20M, ideally between $7-15M

EBITDA

Growth

Industries

Valuations

Geography

Market Insights

Enterprise SaaS Momentum

VC funding in enterprise SaaS reached $22B across 751 deals in Q2 2025, with nearly half of all capital going to AI-native platforms. Investors are aggressively backing solutions that redefine entire software categories. Source: Pitchbook

Cybersecurity Tailwinds

Cybersecurity startups raised $3.3B in Q1 2025, with US federal spending hitting a record $3B budget for the Cybersecurity and Infrastructure Security Agency. Demand for security operations and identity access management continues to accelerate.Source: Pitchbook

Infrastructure SaaS Resilience

Infrastructure SaaS secured $3.5B in Q1 2025 across 98 deals. Segments like DevOps ($1.2B) and Data Software & Systems ($1.1B) led the way, showing strong demand for AI-driven infrastructure and data platforms. Source: Pitchbook

Enterprise SaaS Momentum

E-commerce VC deal value rebounded to $2.9B in Q1 2025 across 134 deals, but the sector is entering a plateau phase. The long-term opportunity lies in agentic AI and interactive commerce, reshaping how consumers engage and purchase. Source: Pitchbook

Applied AI Dominance

AI led early-stage activity with $1.1B across 35 deals in Q1 2025, accounting for nearly 23% of total value. The shift is toward applied and agentic AI deployment tools and vertical specific applications rather than foundation models. Source: Pitchbook

Valuation Reset in SaaS

Median EV/TTM revenue multiples for public enterprise SaaS companies stabilized at 3.8x in Q2 2025, down from 6–8x just two years ago. The gap between AI-first platforms (15–20x ARR) and traditional SaaS (6–8x ARR) highlights where investors see defensibility. Source: Pitchbook

M&A Roars Back

Enterprise SaaS M&A surged 36.8% QoQ to $58B in Q2 2025, led by 12 megadeals that accounted for three- quarters of total value. CRM acquisitions alone jumped 273% to $18B, signaling intense strategic appetite. Source: Pitchbook

Exit Market Revival

Despite volatility, Q2 2025 recorded 100 enterprise SaaS exits, including Hinge Health’s $2.3B IPO and Weights & Biases’ $1.7B M&A. A renewed IPO pipeline suggests liquidity is returning to the sector. Source: Pitchbook

Cybersecurity Consolidation

Platform players are acquiring aggressively to fill product gaps. Customers are shifting from point solutions to broad security suites, driving consolidation across application, endpoint, and identity security segments. Source: Pitchbook

Data Infrastructure in Focus

Major funding rounds in 2025 spotlight databases and AI-optimized infrastructure: Celestial AI, Supabase, and Turing each raised hundreds of millions at $2–2.5B valuations, underscoring infrastructure as the new growth engine. Source: Pitchbook

Federal Catalysts for Cyber

The US government allocated a record $3B to the Cybersecurity and Infrastructure Security Agency in FY25. Federal commitment remains a powerful tailwind for private cybersecurity innovation and contracting opportunities. Source: Pitchbook

Enterprise SaaS Momentum

VC funding in enterprise SaaS reached $22B across 751 deals in Q2 2025, with nearly half of all capital going to AI-native platforms. Investors are aggressively backing solutions that redefine entire software categories. Source: Pitchbook

Cybersecurity Tailwinds

Cybersecurity startups raised $3.3B in Q1 2025, with US federal spending hitting a record $3B budget for the Cybersecurity and Infrastructure Security Agency. Demand for security operations and identity access management continues to accelerate.Source: Pitchbook

Infrastructure SaaS Resilience

Infrastructure SaaS secured $3.5B in Q1 2025 across 98 deals. Segments like DevOps ($1.2B) and Data Software & Systems ($1.1B) led the way, showing strong demand for AI-driven infrastructure and data platforms. Source: Pitchbook

Enterprise SaaS Momentum

E-commerce VC deal value rebounded to $2.9B in Q1 2025 across 134 deals, but the sector is entering a plateau phase. The long-term opportunity lies in agentic AI and interactive commerce, reshaping how consumers engage and purchase. Source: Pitchbook

Applied AI Dominance

AI led early-stage activity with $1.1B across 35 deals in Q1 2025, accounting for nearly 23% of total value. The shift is toward applied and agentic AI deployment tools and vertical specific applications rather than foundation models. Source: Pitchbook

Valuation Reset in SaaS

Median EV/TTM revenue multiples for public enterprise SaaS companies stabilized at 3.8x in Q2 2025, down from 6–8x just two years ago. The gap between AI-first platforms (15–20x ARR) and traditional SaaS (6–8x ARR) highlights where investors see defensibility. Source: Pitchbook

M&A Roars Back

Enterprise SaaS M&A surged 36.8% QoQ to $58B in Q2 2025, led by 12 megadeals that accounted for three- quarters of total value. CRM acquisitions alone jumped 273% to $18B, signaling intense strategic appetite. Source: Pitchbook

Exit Market Revival

Despite volatility, Q2 2025 recorded 100 enterprise SaaS exits, including Hinge Health’s $2.3B IPO and Weights & Biases’ $1.7B M&A. A renewed IPO pipeline suggests liquidity is returning to the sector. Source: Pitchbook

Cybersecurity Consolidation

Platform players are acquiring aggressively to fill product gaps. Customers are shifting from point solutions to broad security suites, driving consolidation across application, endpoint, and identity security segments. Source: Pitchbook

Data Infrastructure in Focus

Major funding rounds in 2025 spotlight databases and AI-optimized infrastructure: Celestial AI, Supabase, and Turing each raised hundreds of millions at $2–2.5B valuations, underscoring infrastructure as the new growth engine. Source: Pitchbook

Federal Catalysts for Cyber

The US government allocated a record $3B to the Cybersecurity and Infrastructure Security Agency in FY25. Federal commitment remains a powerful tailwind for private cybersecurity innovation and contracting opportunities. Source: Pitchbook